Optimal Statistical Inference in Financial Engineering

Masanobu Taniguchi author Junichi Hirukawa author Kenichiro Tamaki author

Format:Hardback

Publisher:Taylor & Francis Inc

Published:26th Nov '07

Currently unavailable, and unfortunately no date known when it will be back

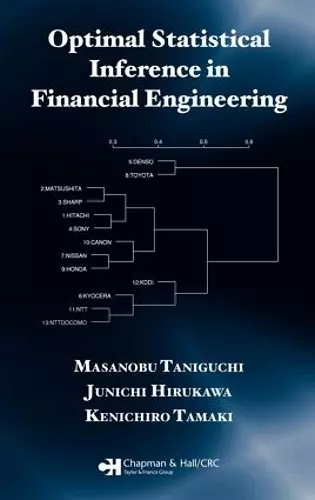

Until now, few systematic studies of optimal statistical inference for stochastic processes had existed in the financial engineering literature, even though this idea is fundamental to the field. Balancing statistical theory with data analysis, Optimal Statistical Inference in Financial Engineering examines how stochastic models can effectively describe actual financial data and illustrates how to properly estimate the proposed models. After explaining the elements of probability and statistical inference for independent observations, the book discusses the testing hypothesis and discriminant analysis for independent observations. It then explores stochastic processes, many famous time series models, their asymptotically optimal inference, and the problem of prediction, followed by a chapter on statistical financial engineering that addresses option pricing theory, the statistical estimation for portfolio coefficients, and value-at-risk (VaR) problems via residual empirical return processes. The final chapters present some models for interest rates and discount bonds, discuss their no-arbitrage pricing theory, investigate problems of credit rating, and illustrate the clustering of stock returns in both the New York and Tokyo Stock Exchanges. Basing results on a modern, unified optimal inference approach for various time series models, this reference underlines the importance of stochastic models in the area of financial engineering.

This book can be recommended to scholars and PhD students interested in finance and time series.

—Journal of Times Series Analysis, April 2010

ISBN: 9781584885917

Dimensions: unknown

Weight: 657g

378 pages