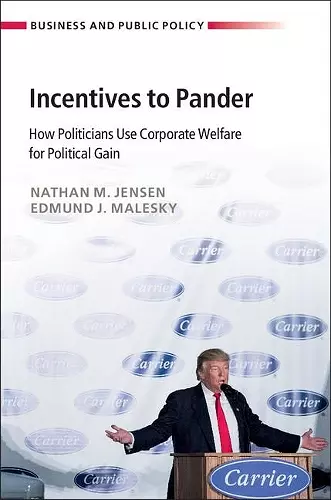

Incentives to Pander

How Politicians Use Corporate Welfare for Political Gain

Edmund J Malesky author Nathan M Jensen author

Format:Hardback

Publisher:Cambridge University Press

Published:15th Mar '18

Currently unavailable, and unfortunately no date known when it will be back

This hardback is available in another edition too:

- Paperback£30.99(9781108408530)

An examination of why politicians choose to employ targeted tax incentives to firms that are inefficient and distortionary.

A rigorous analysis of fiscal incentives, arguing that politicians choose to employ economically inefficient policies to claim credit for economic development. This book will be of interest to researchers and teachers in the fields of political science, economics, public policy, urban development and management.Policies targeting individual companies for economic development incentives, such as tax holidays and abatements, are generally seen as inefficient, economically costly, and distortionary. Despite this evidence, politicians still choose to use these policies to claim credit for attracting investment. Thus, while fiscal incentives are economically inefficient, they pose an effective pandering strategy for politicians. Using original surveys of voters in the United States, Canada and the United Kingdom, as well as data on incentive use by politicians in the US, Vietnam and Russia, this book provides compelling evidence for the use of fiscal incentives for political gain and shows how such pandering appears to be associated with growing economic inequality. As national and subnational governments surrender valuable tax revenue to attract businesses in the vain hope of long-term economic growth, they are left with fiscal shortfalls that have been filled through regressive sales taxes, police fines and penalties, and cuts to public education.

'The puzzle of investment incentives like tax breaks and regulatory exemptions is that although they are generally inefficient, governments around the world - from Kansas to Vietnam - use them to attract investors. In this provocative and wide-ranging book, Jensen and Malesky show that politicians choose these policies because they reap political benefits from doing so. By identifying the political logic that drives inefficient policies, this book reveals how citizens may press for better policymaking.' Thomas Pepinsky, Cornell University, New York

'Is all politics local? In this intriguing study, Jensen and Malesky show that though separated by geography and political systems, politicians in the United States, Canada, Russia, and Vietnam all use fiscal policy to generate and sustain political support. The authors masterfully weave a variety of evidence - individual level surveys and original data on policymakers' incentives - to show how short term fiscal policies often have dramatically negative long term consequences.' David Leblang, University of Virginia

ISBN: 9781108418904

Dimensions: 235mm x 156mm x 18mm

Weight: 500g

268 pages