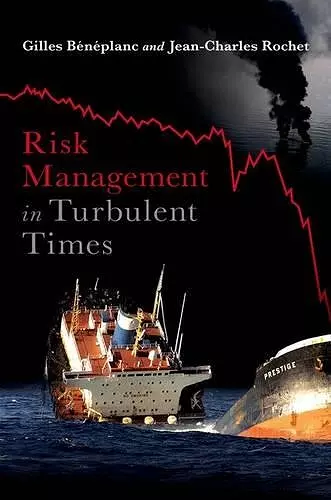

Risk Management in Turbulent Times

Jean-Charles Rochet author Gilles Beneplanc author

Format:Hardback

Publisher:Oxford University Press Inc

Published:8th Sep '11

Currently unavailable, and unfortunately no date known when it will be back

The subprime crisis has shown that the sophisticated risk management models used by banks and insurance companies had serious flaws. Some people even suggest that these models are completely useless. Others claim that the crisis was just an unpredictable accident that was largely amplified by the lack of expertise and even naivety of many investors. This book takes the middle view. It shows that these models have been designed for "tranquil times", when financial markets behave smoothly and efficiently. However, we are living in more and more "turbulent times": large risks materialize much more often than predicted by "normal" models, financial models periodically go through bubbles and crashes. Moreover, financial risks result from the decisions of economic actors who can have incentives to take excessive risks, especially when their remunerations are ill designed. The book provides a clear account of the fundamental hypotheses underlying the most popular models of risk management and show that these hypotheses are flawed. However it shows that simple models can still be useful, provided they are well understood and used with caution.

With its mention of insurance-linked securities and catastrophe bonds, and its various references to catastrophe-insurance risks such as earthquakes and terrorism, Risk Management in Turbulent Times is a highly topical addition to the literature on risks and catastrophes. * Gordon Woo, The Mathematical Intelligencer *

ISBN: 9780199774081

Dimensions: 157mm x 236mm x 18mm

Weight: 454g

224 pages